does new mexico tax pensions and social security

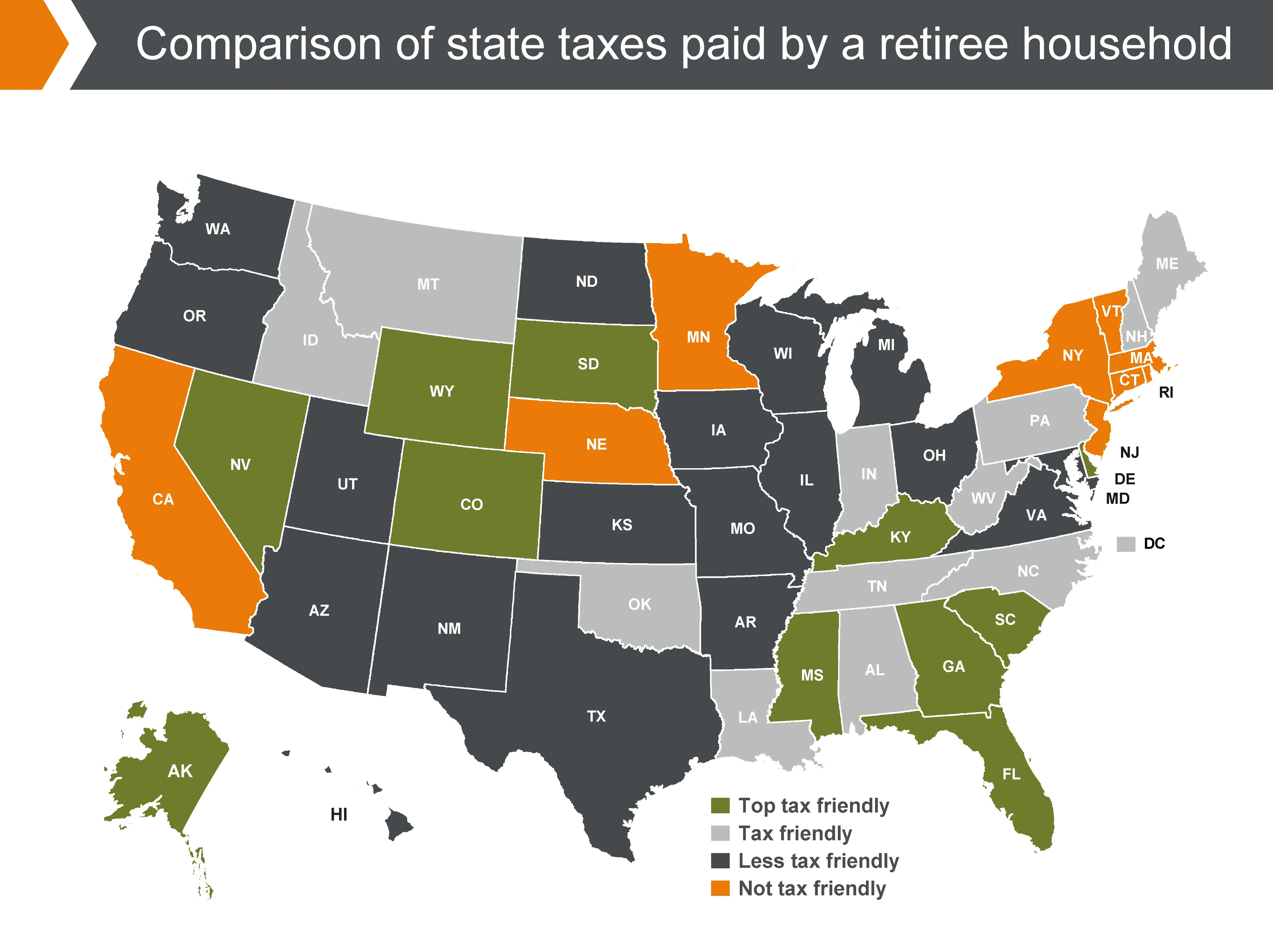

Mississsippi is an excellent state for retirees and thus a part of the states that dont tax pensions and social security as long as you retire at the appropriate time at the. New Mexico taxes Social Security income at a rate of 17 to 59.

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

This has been in.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

. 52 rows Retirement income and Social Security not taxable. At least five bills were introduced to accomplish this goal and Governor Lujan Grisham endorsed the repeal of the Social Security tax in her State of the State address. And 12 states Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico Rhode Island Utah Vermont and West Virginia can tax all or part of your Social Security benefits.

For a couple filing jointly the minimum is 32000. However a handful of states dont tax pension income at all no matter how old you are or. Like Montana New Mexico uses the same thresholds as the federal government for exempting lower-income residents.

45 rows The following chart provides an overview of how states treat retirement pension and Social Security Income. New Mexicos Social Security tax also has a negative impact on our economy. If your gross income is 34000 or more up to 85 may be taxable.

Last February 17 the New Mexico State House approved legislation to reform its public pension system. It also shows the starting point for computing state income tax liability. If youre an individual filer and had at least 25000 in gross income including Social Security for the year up to 50 of your Social Security benefits may be taxable.

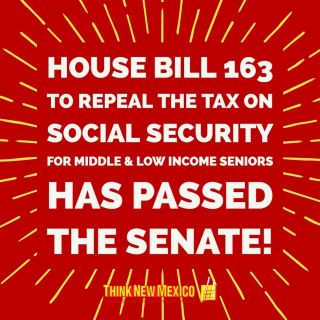

Its important to note that New Mexico does tax retirement income including Social Security. The Senate had already approved. Social Security Tax Repeal.

As such we have concluded that we will be leaving New Mexico when we retire to live in a state that does not tax social security eg. Social Security retirement benefits are taxable in New Mexico but they are also partially deductible. When New Mexicans receive their paychecks the money that is taken out for Social Security is already subject to state.

If seniors were able to keep the money that they now pay in taxes on their Social Security benefits much of it would. Colorado connecticut kansas minnesota missouri montana nebraska. During the 2022 legislative session Think New Mexico advocated for legislation to repeal the state tax on Social Security income.

For most retirees social security is their primary source of income and in the majority of the us your state will not tax you on it. The bill SB5 was. 3 So how much are we talking about.

New Mexico tax rates range from 17 to 59. The minimum for a couple is 44000. For more than half a century after Social Security was enacted in 1935 Social.

Your state might have a pension exclusion but chances are its limited based on your age andor income. For persons age 65 and older the deduction is 8000. Yes Deduct public pension up to 37720 or maximum social security benefit if Missouri income is less than 85000 single and 100000 married.

If taxed the tax would run from 17 to 59 assuming DFA will certify that FY2020 revenues will not exceed FY2019s by five percent. According to Wolters Kluwer a tax publishing company 27 states tax some but not all of retirement or pension income. AZ WY SD or.

Typically these states tax pension income only above a certain level of adjusted gross income. Which states tax Social Security and pensions. For seniors the income limits to be eligible for the exemption are 28500 of AGI for single filers or 51000 for married filers.

The exemption is 2500 for taxpayers under the age of 65. For non-seniors the income. New Mexico State Capitol Santa Fe New Mexico USA.

Unfortunately both pensions and social security payments are taxed in most states as they are deemed ordinary income. Low-income taxpayers may also qualify for a property tax rebate even if they rent their primary residence. You can find additional details on these topics and more in the CCH State Tax Smart Charts on CCH AnswerConnect.

C Per 1000 of included Social Security benefits the New Mexico income tax due will vary depending on the taxpayers filing status and tax bracket. The states tax on Social Security benefits is a form of double taxation. Other filers older than 55 may exclude 6000.

Even if some states dont tax these payments that generally depends on your. For higher incomes may qualify for partial exemption. Yes Up to 8000 exclusion.

The compromise reached last week in New Mexico will remove taxes on Social Security for individuals with incomes up to 100000 and up to 150000 for couples filing jointly. Currently New Mexico includes all Social Security benefits in the taxable income base though the state provides a deduction that reduces the taxability of all retirement income. For example Iowa allows joint filers 55 and older to exclude 12000 from state taxable income.

New Mexico Retirement Tax Friendliness Smartasset

Retirement Security Think New Mexico

How Taxes Can Affect Your Social Security Benefits Vanguard

New Mexico Retirement Tax Friendliness Smartasset

Retirement Security Think New Mexico

Tax Withholding For Pensions And Social Security Sensible Money

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Retirement Security Think New Mexico

Tax Withholding For Pensions And Social Security Sensible Money

States With The Highest And Lowest Taxes For Retirees Money

New Mexico Passes Legislation Including Social Security Tax Cuts Child Tax Credit And Tax Rebates Up To 500 Gobankingrates

Taxation Of Social Security Benefits Mn House Research

Social Security New Mexico Moves Closer To Eliminating Taxes On Most Social Security Benefits Gobankingrates

Bill To Cut Social Security Taxes Heads To Governor S Desk In New Mexico Thinkadvisor

How Do Dividends Affect Social Security Benefits Intelligent Income By Simply Safe Dividends

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Retirement Security Think New Mexico

New Mexico Eliminates Social Security Taxes For Many Seniors Thinkadvisor